When it comes to offering financing, not all customers have the same needs. Here we break down how to identify the type of customer you are working with and match the plans that work best for them.

Fixed rate plans – a fixed-interest rate remains the same over the life of the loan.

Financing plans with a fixed rate are a good option for customers sensitive to how the monthly payments of their loan will fit their monthly budget. Generally, these monthly-payment customers will also want to lock in a competitive interest-rate plan for the duration of their loan term.

You can offer a fixed-rate plan to customers who may not have cash in hand to immediately begin with the project but will like to proceed, and in certain cases, add upgrades that will increase their value and satisfaction of the HVAC job done on their home.

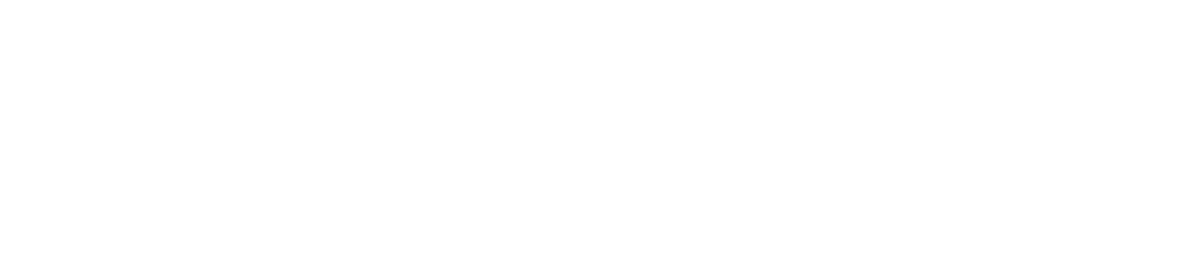

Here’s an example of a fixed-rate loan:

Promotional rate plans – a promotional rate includes plans with zero-interest or deferred interest for a certain promotional period.

Promotional rates appeal to cash customers who prefer to keep their money and use financing instead to add options/upgrades to their HVAC job.

Both Prime and Second Look financing have loan options with promotional rates.

Promotional rate plans include:

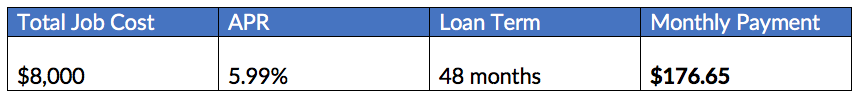

- Zero-interest plans – with this type of plan, customers are not charged interest for the duration of the promotional loan-term period AND are required to make a minimum-monthly payment. If they don’t complete the payment during the loan-term period, they get charged a certain interest (i.e., 26.99%) on their outstanding balance.

Here is an example:

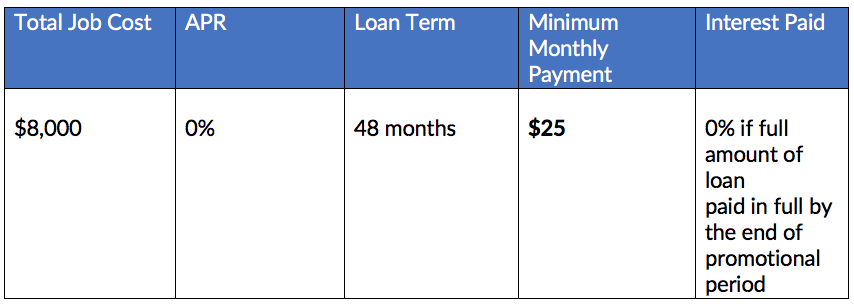

- 0%, deferred interest plans– with this type of plan, customers are not charged interest for the duration of the promotional term and ARE NOT required to make a minimum-monthly payment.

Here is an example:

What you can gain from offering different financing options with Credit for Comfort

Every finance plan we’ve touched on will be a good option for different segments of your customer base. However, if you want to maximize the benefits of offering financing on every HVAC job, you need the ability to help all your customers.

Credit for Comfort understands this fact. That’s why our app offers you the possibility to provide financing plans from Prime and 2nd Look lenders to your customers.

We also give you flexibility. You can provide financing for your customers via one or multiple finance partners. And now, thanks to our new partnership with Service Finance, you can begin providing financing for your customers if you’ve been in business only a year.

If you decide to provide both Prime and 2nd Look plans, our waterfall feature makes it easy for customers to apply for both types of loans in minutes. So, if your customers are not approved for a Prime loan, they have the option to immediately apply for a 2nd look alternative with only a soft pull that won’t affect their credit score.

The ball is now on your court. If you’re ready to take the next step, go ahead and book a demo now.